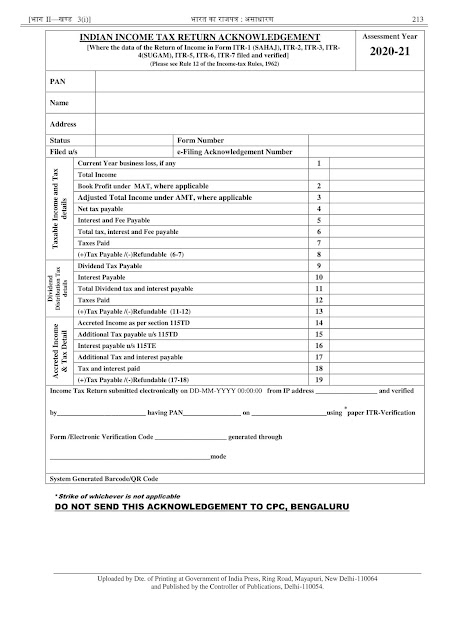

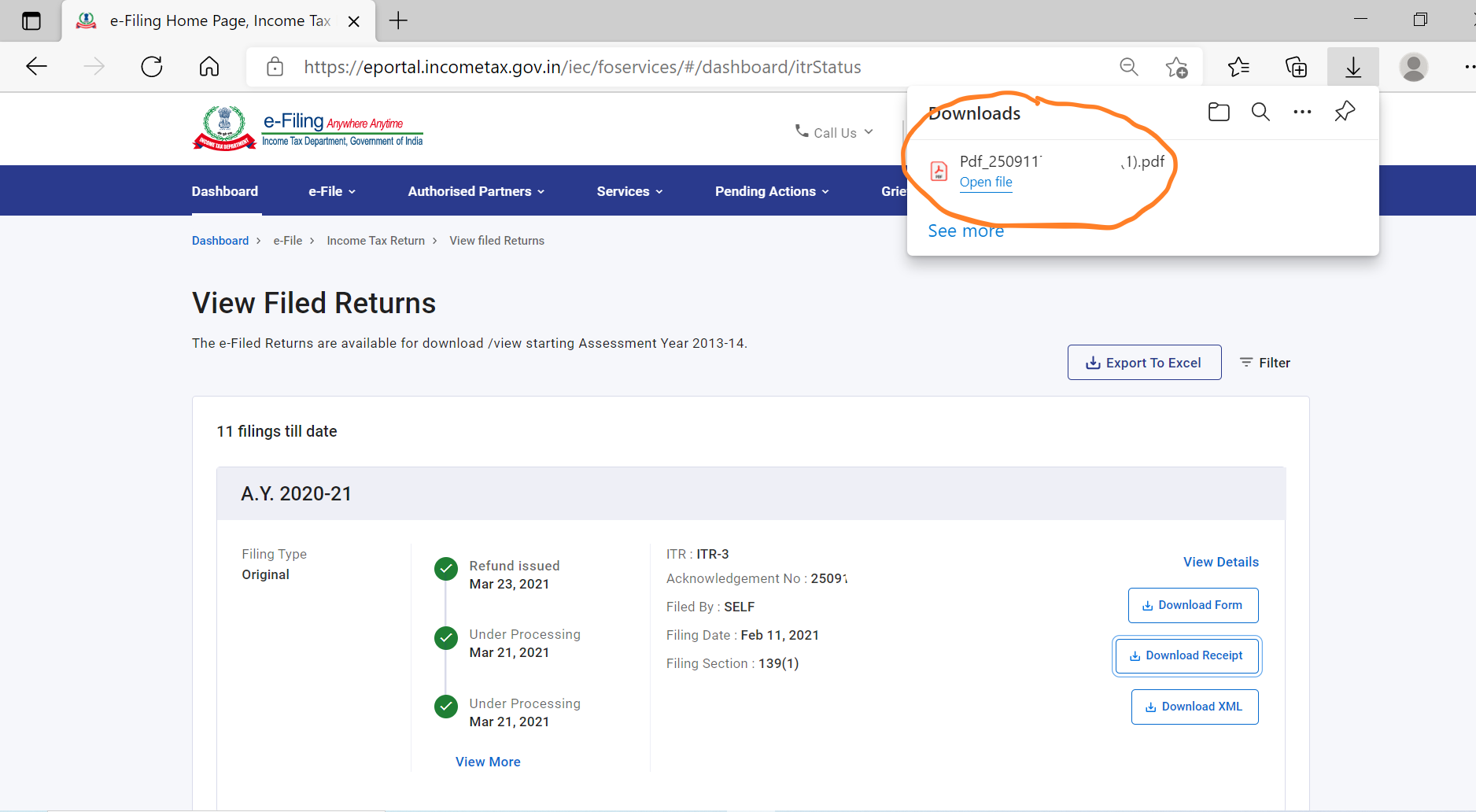

The deadline for filing tax returns online is July 31. Through this article, you’ll understand how to download ITR acknowledgment and obtain your ITR from the convenience of your own home or workplace. It allows taxpayers to check the validity of their e-filing. Please allow 30 days for processing.The ITR stands for Income Tax Return, and it is generated by the IT department. The amount due will be billed to you in the letter we send upon completion of your request. There is a charge of twenty-five cents ($.25) per page. See the instructions on the back of the form for identification requirements.

provide a form of identification from which your signature can be validated.specify as best you can the type of information being requested,.If the copies must be certified, mark an X in the box on the Reason for request line. We will send a photocopy of the return, if available. Returns filed before 1990 are not available.Īlong with other forms, you may request a copy of a filed Form DTF-802, Statement of Transaction - Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile, by including the Vehicle Identification Number (VIN) in Column A of the Form DTF-505, Authorization for Release of Photocopies of Tax Returns and/or Tax Information. To request copies of e-filed or paper returns for tax years 1990 and forward, complete and mail Form DTF-505, Authorization for Release of Photocopies of Tax Returns and/or Tax Information. Log in to view Create account All other returns Tax professionals: View your client's e-filed returns through your Tax Professional Online Services account by having your client complete and sign E-ZRep Form TR-2000, Tax Information Access and Transaction Authorization. fiduciary (ten most recent filing periods since 2008).withholding (nine most recent filing periods).

fuel use (six most recent filing periods).sales and use (five most recent filing periods).corporation (ten most recent filing periods since 2008).Log in or create an Online Services account to view and print a copy of your e-filed return for the following tax types:

0 kommentar(er)

0 kommentar(er)